DaWinKS Co., Ltd. (CEO Jong-myung Lee), a company specializing in blockchain fintech, supplies the ‘Dpec Platform/DP’ solution for digital bank operation to the Republic of Seychelles, located in the western part of the Indian Ocean.

Seychelles is a republic with about 115 islands in the western Indian Ocean, with its capital city Victoria, and its currency Seychelles rupee. It is a mixed type of developing country with a very high dependence on tourism. Dhigu Island and Mahe Island are famous as world-class tourist destinations.

Many countries worldwide endeavor to reduce greenhouse gas emissions through blue carbon. In Seychelles, the' Blue Bond' project conducts education on sustainable fishing practices and hydroponics. In October 2018, the world's first $15 million blue bond was issued to support ESG(Environment Social Governance), marine, and fishery projects, and the raised fund is being used to protect marine ecosystems and prevent pollution.

DaWinKS Co-Founder Bruce Jung had a meeting with Debbi Monty, the head of the Seychelles Presidential Foundation, on the 2nd, who shared the view that DaWin's Digital ATM and QR Pay Solution will be an innovative digital financial service that can upgrade the Seychelles financial environment to the next level and agreed on introduce digital financial services to locals and foreigners by installing mobile-based blockchain fintech technology provided by DaWin within a short period. It is said that it could be possible as early as this year as the company has garnered the know-how by supplying related technologies to the first digital banks in Nicaragua, Latin America.

Right/ DaWinKS Co-Founder Bruce Jeong [Courtesy of DaWinKS]

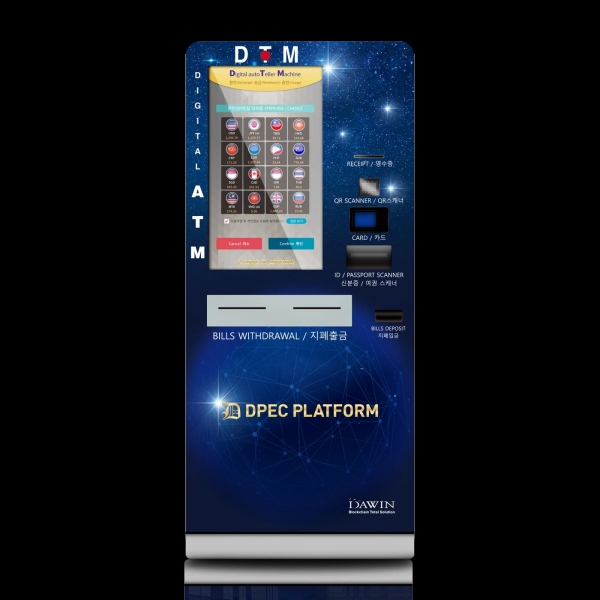

DaWinKS installed a digital ATM (DTM/Digital autoTeller Machine) at Accuon Savings Bank located in Seomyeon Busan Financial Center in December of last year and started untact currency exchange service. This was recorded as the first domestic case of collaboration between a financial institution and a fintech company.

a digital ATM at the Accuon Savings Bank Busan Financial Center. [Courtesy of DaWinKS]

DaWinKS CEO Jong-myung Lee said, "Based on advanced industry-leading untact ID authentication KYC (Know Your Customer) and AML (Anti-Money Laundering) solutions and multinational foreign exchange banknote recognition technology, the installation and operation of DTM, which provides direct currency exchange and overseas remittance services, is in full swing to enter the overseas market as well as the domestic market.” and added, "I hope it will be an opportunity to expand into Latin America's neighboring countries and global markets by participating in the Korea-CABEI Cooperation Forum to commemorate the opening of the historic CABEI (Central American Bank for Economic Integration) on the 11th."

후원하기

- 정기후원

- 일반 후원

- ARS 후원하기 1877-0583

- 무통장입금: 국민은행 917701-01-120396 (주)메이벅스

- 후원금은 CNN, 뉴욕타임즈, AP통신보다 공정하고

영향력있는 미디어가 되는데 소중히 쓰겠습니다.

Fn투데이는 여러분의 후원금을 귀하게 쓰겠습니다.